First disclaimer is all these lines are not prepared by me yesterday... they are here for some time now.. as per the trend line and Nifty trend it never closed below the levels of 5972.5 but yes it is giving respect to the resistance around 6100 levels which it tested on 12 Feb and another 7 trading days before... Lower levels needs to be decisively breached by closing below this level for 3 days in a row to confirm the trend (unfortunately it will be too late if the markets have to fall to take advantage of the position).

February 14, 2014

NSE NIFTY: Chart Update - 13 Feb 14

First disclaimer is all these lines are not prepared by me yesterday... they are here for some time now.. as per the trend line and Nifty trend it never closed below the levels of 5972.5 but yes it is giving respect to the resistance around 6100 levels which it tested on 12 Feb and another 7 trading days before... Lower levels needs to be decisively breached by closing below this level for 3 days in a row to confirm the trend (unfortunately it will be too late if the markets have to fall to take advantage of the position).

Indusind Bank: Chart update - 13 Feb 14

Again the stock bounced back to higher levels. Now, the time is back again and the stock is taking support at the trend line.

Will be interesting to see if it is able to hold the trend line and move higher or this is the end of stock rally for this one.. in later case be ready for very low levels may be 300 to start with and 225 later..btw my financial analysis on stock says it is better than HDFC Bank (comparison done last time in a different post)

Disclosures: I don't hold any open position in either stocks (investment or trading)

February 13, 2014

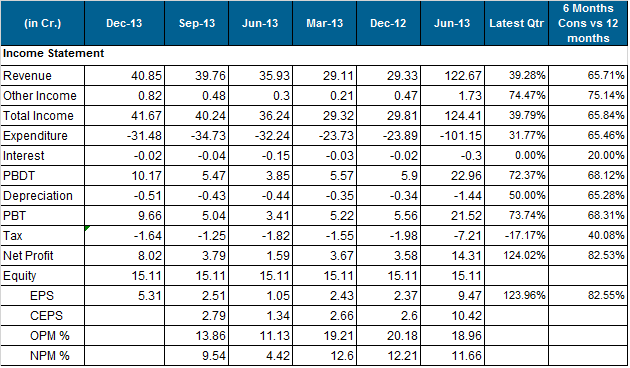

Caplin Point: Result update Q2 2013-14

Results taken from BSE India.com

Result highlights:

1. Revenue increased by 39% yoy and 27% qoq

2. Net profit more than doubled to 8cr leading to eps of more than Rs 5 per share the qtr making it almost 8 rs for the six months period this was 9.5rs for full last year..

3. Cost of material consumed has reduced from 8.16cr to 5.41cr. I am not sure how this is possible unless they are more in trading now rather than actually producing goods. This is validated by increase in purchase of stock in trade from 13.1cr to 18.7cr

4. Employee benefit expenses have increased almost 80% yoy. This might be due to new plants starting production.

My take on the results:

On face value things look awesome and going by Indian standards of disclosures and working of management nothing to worry about, infact it is time to sit back and enjoy the benefits of investment made in the stock.

Disclaimer: I own 1250 shares (previously 1500) sold 250 shares recently to recover my entire cost of investment plus took some profits off the table

February 06, 2014

DCB Bank Ltd: Techincally hit

As stated in the previous post, the stock was looking good to take support at 50 level... Eureka stock did took support at those levels.. now once again it is aiming to test the previous high (oops am I expecting this too early or should I wait for one more closing)

Let see what time has in store for us.

Happy investing :)

Gujarat Alkaline and Chemicals Ltd: Followup

As expected the results did not justify the price movement. We all saw that market is trying to be stable to positive in last two days but this stock in particular is on a falling spree. you cannot see the daily falls as this is a weekly chart. The point over here is invest based on logic not by just following some one blindly.

Happy investing :)

Subscribe to:

Posts (Atom)