Investment update:

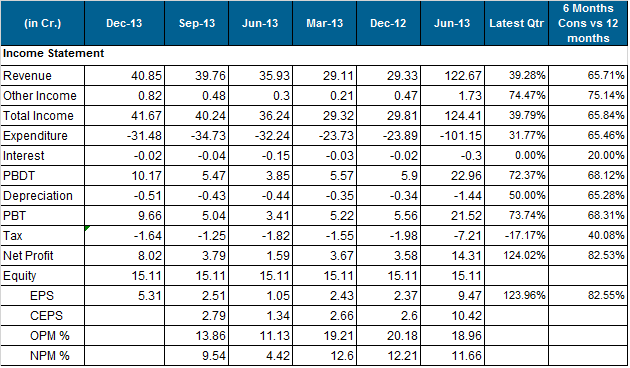

Results of the company are really good.. profit up more than 400% yoy but almost flat on qoq basis.

Current price of Rs 440+ looks on higher side for the stock for new investments.. If you holding the stock continue to hold it.. We might see un-imaginable levels in the stock..

Happy investing,

Atul

Disclaimer: I am holding shares of the company

Results of the company are really good.. profit up more than 400% yoy but almost flat on qoq basis.

Current price of Rs 440+ looks on higher side for the stock for new investments.. If you holding the stock continue to hold it.. We might see un-imaginable levels in the stock..

Happy investing,

Atul

Disclaimer: I am holding shares of the company